Highlighted

Transactions.

Navigating the Tough Deals

Facilitating a sale while mitigating a $500,000 prepayment penalty

-

The buyer’s offer was perfect, but our client’s yield maintenance prepayment penalty was prohibitive. How could our client avoid a prepayment penalty of +10% and still make sense of selling his 103,000 sf Sunrise Florida office building? Fortunately, our client owned an equally valuable office building in W. Palm Beach (debt free) and with the lender’s flexibility and LD&A’s careful valuation and cost/benefit analysis, we were successful in coordinating a collateral swap which enabled our client to take advantage of the buyer’s attractive offer. The collateral swap was groundbreaking for the lender and between the lender’s flexibility and LD&A’s persistence, the Sunrise property was sold on a cost-effective basis.

The Particulars:

Atrium West was a 103,000 sf two story office building located in Sunrise Florida, a market which had limited upside potential.

Northpoint Corporate Center is 98,410 sf, 5-story office building located in a superior W. Palm Beach submarket.

The expensive prepayment penalty resulted from a significant drop in reinvestment rates from the original 15-year fixed rate financing in 2015.

Navigating the Changing Winds of State Government for our Client

-

The proposed 125 room Hyatt Place Development couldn’t be better located and the demand for additional hotel rooms within walking distance of Providence’s International Airport was obvious. LD&A’s challenge was how to assist our client secure Rhode Island State financial incentives to make this development feasible.

The process was both protracted and iterative in meeting Rhode Island’s Economic Development Agency’s demands for a litany of financial models which evidence the need for State sponsored financial incentives and the pathway for repayment. Through a team effort with our sponsor and his legal counsel we were successful in securing Rebuild Rhode Island Tax Credits and a 20-year TIF (Tax Increment Financing) which were critical elements of the financing of this attractive development.

Our task not complete, as we then secured competitively priced construction mini-perm financing from a Massachusetts based lender to make this project a reality.

The Particulars:

Our client secured Rebuild Rhode Island Tax Credits which were issued by the State of Rhode Island and could either be redeemed annually by the state or sold into the secondary market to provide additional project equity.

The 20-year (TIF) Tax Increment Financing Agreement, which was tied to hotel sales taxes, provided significant additional support in financing project costs.

Construction and min-perm financing which covered the last dollar financing on a floating rate basis during construction converting to a fixed rate perm loan upon stabilization.

Follow up support by negotiating a temporary suspension of interest and principal payments during the height of COVID until such time which allowed hotel revenues to realize pre-covid levels.

Financing the Parts to Value the Whole

-

Ten former mill buildings in limited use or disrepair, along a 00-mile road on the outskirts Providence. A single vision to create a 15-acre multi-use commercial, retail and residential economic development initiative. And a big picture view by Larew Doyle to financially parse these properties according to condition, opportunity or planned use into a unified make-it-work package.

The Particulars:

A 3-year project to rehabilitate 10 mill buildings encompassing a quarter million square feet.

Combination of bridge loans to finance retrofits and renovations – along with long-term perm loan to ensure long-term financial assurance and favorable returns.

Use of historical tax credits to navigate more flexible terms, and use of a tax ‘treaty’ based on affordable housing accommodations.

Hands-on work with local and state environmental, historic, civic and government agencies to meet their requirements and keep the project on track and on budget.

Other Highlighted Transactions

Larew Doyle & Associates arranges $16 million in financing for a 103 Unit Apartment Complex

Larew Doyle & Associates is pleased to announce the recent financing of 125 South Harrison Street Apartments, a 103 Unit Apartment Complex in East Orange, New Jersey. The $16,000,000 was financed with an agency lender. This non-recourse permanent loan was interest-only for 10 years

Larew Doyle & Associates provides $6 million financing for Chestnut Park Apartment Complex

Larew Doyle & Associates is pleased to announce the placement of a $6 million permanent loan to an attractive 56-unit garden-style apartment complex, conveniently located within minutes of Interstate 95, interstate 295, Routes 1 and 152 in North Attleboro, Massachusetts.

Larew Doyle & Associates secures a $24 million permanent loan on a newly constructed building that is leased to a Charter School operator

Larew Doyle & Associates is pleased to announce the financing of a newly constructed 66,815 sf building that is leased to a Charter School Operator in Bronx, NY. The $24,000,000 loan was financed by a regional bank.

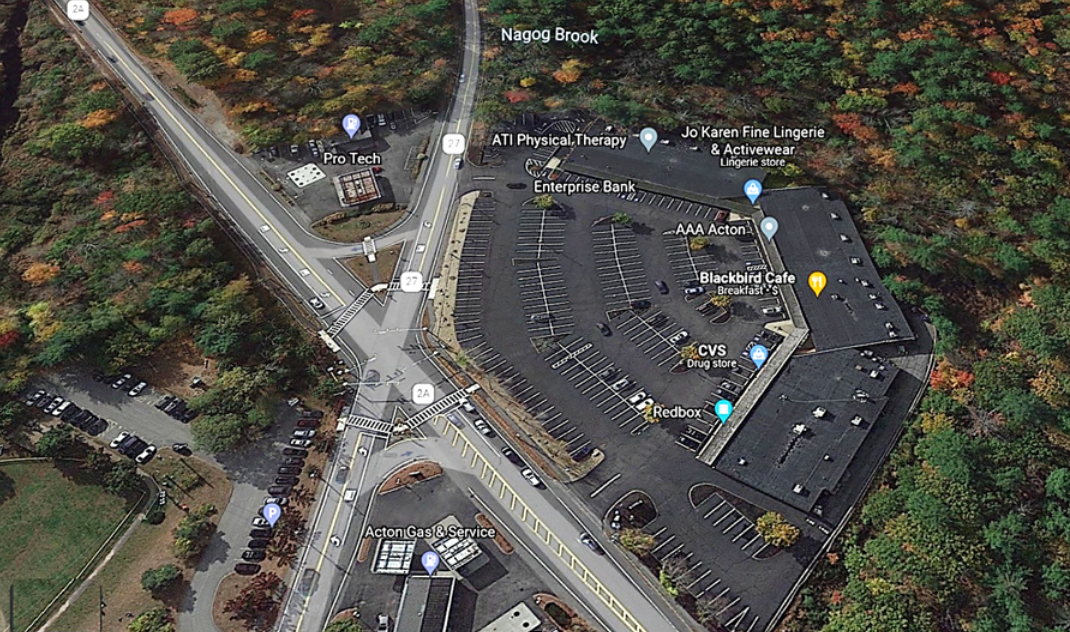

Larew Doyle & Associates arranges $9 million Acquisition Financing for Acton Woods Plaza

Larew Doyle & Associates is pleased to announce the placement of a $9 Million acquisition loan on this 42,000 sf attractively located retail center situated at the intersection of Routes 27 and 2A in Acton Massachusetts. The $9 million loan was financed by a regional bank which fixed the interest rate for 10 years.

Larew Doyle & Associates arranges $25 million in financing for a 143,000 sf office building

Larew Doyle & Associates is pleased to announce the recent financing of a 143,000 sf office building in Brooklyn, New York. The $25,000,000 was financed with a money center bank. This non-recourse permanent loan was fixed for 13 years.

Larew Doyle & Associates arranges $9 million in financing for 30-acre site for the construction of Silver Sands Motel

Larew Doyle & Associates is pleased to announce the placement of a $9 million construction loan for a sprawling 30-acre site for the construction of Silver Sands Motel.

Larew Doyle & Associates arranges $3.35 million in financing for a fully leased 30,000 sf industrial building

Larew Doyle & Associates is pleased to announce the recent financing of a fully leased 30,000 sf industrial building in Plainville Massachusetts. The $3,350,000 financing was placed with one of LD&A’s correspondent life insurance companies. This non-recourse loan was fixed for 15 years.

Larew Doyle & Associates arranges $25.5 million in financing for a 207,000 sf industrial building

Larew Doyle & Associates is pleased to announce the recent financing of the Olympic Building, a 207,000 sf industrial building in Long Island, New York. The $25,500,000 financing was placed with one of LD&A’s correspondent life insurance companies. This non-recourse loan was fixed for 20 years.

Contact us.

Just starting a project or pushing to get a deal done? Either way, we need to talk. Give us a call at any of our offices or drop us a line below.

We’re ready to answer your questions and offer some new ideas.